During the first quarter of 2023, Amazon remained the top destination for consumers when they start searching for a product online, according to research published by JungleScout. Although there aren’t often a ton of shopping similarities between boomers, millennials, and Gen Z, the three generations were able to find common ground in their preference for Amazon when searching for a product over other online starting points like search engines, Walmart.com, YouTube, Facebook, TikTok, and Instagram. Shockingly, the valuable, but often overlooked, Gen X demographic was the only group that favored search engines over Amazon.

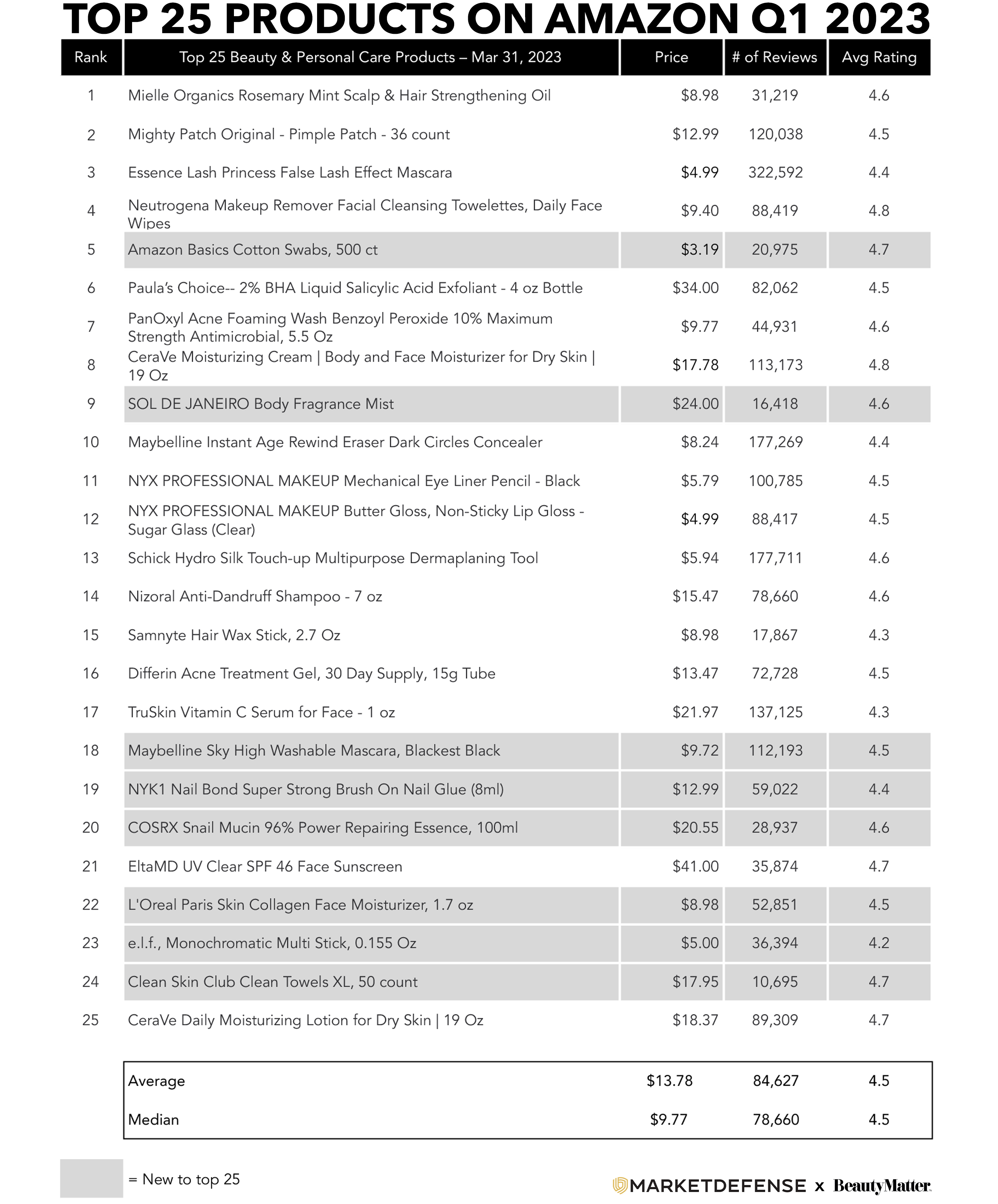

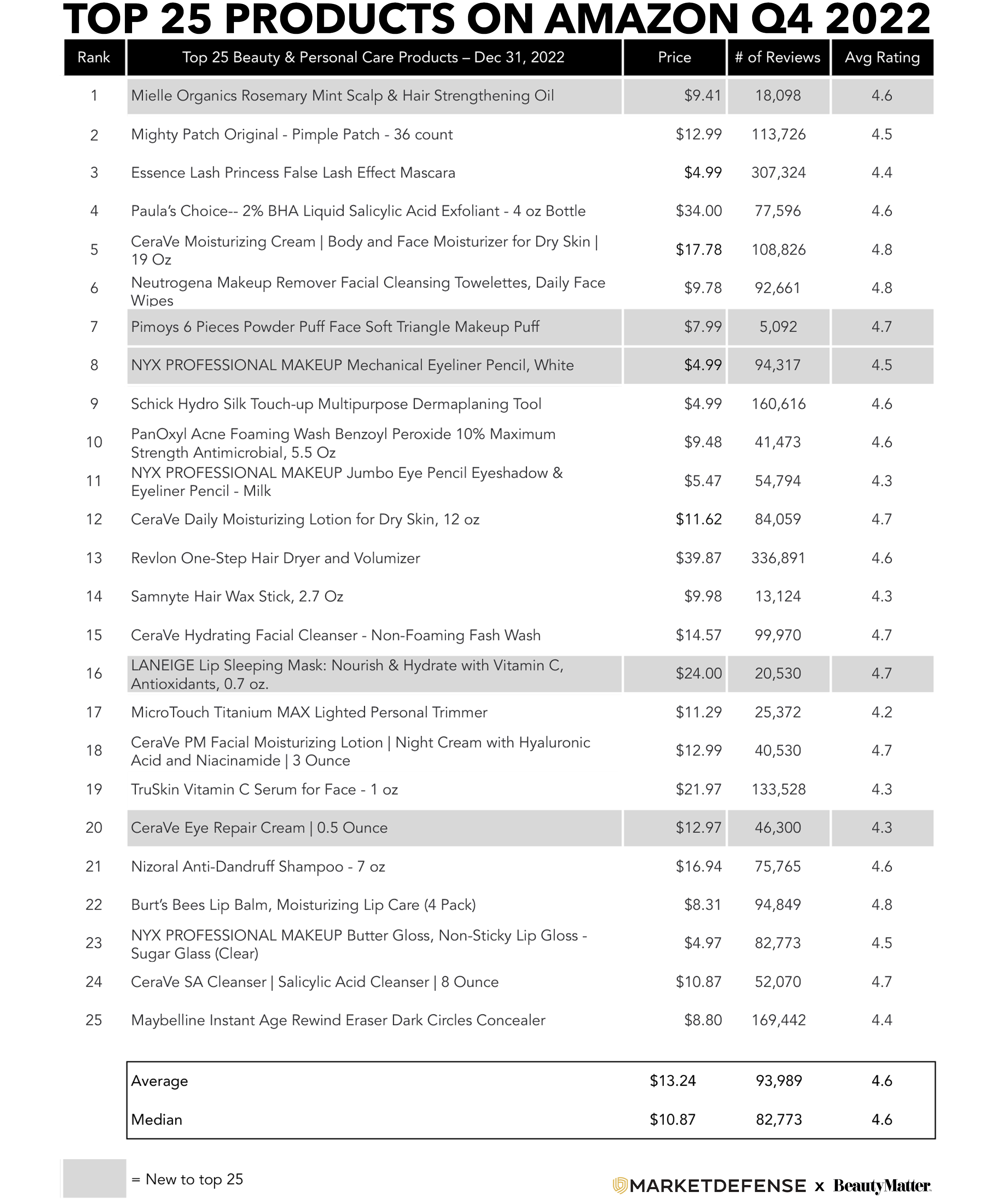

This might help to explain another trend we saw emerge during the first quarter of 2023―the subtle premiumization of consumer preferences when buying beauty on Amazon. According to Vanessa Kuykendall, COO of the Amazon agency, Market Defense, which manages seven of Sephora’s top-selling beauty brands, “While there was a lot of talk in 2022 about consumers cutting back or looking for deals, consumer spending levels were higher in Q1 2023 compared to Q4 2022. In the first quarter, we saw a lot of shakeups and changes to Amazon’s list of Top 25 Beauty and Personal Care Products, with more prestige brands than ever landing on the list. This drove the average MSRP of the list to $13.78, the highest it’s been since Q2 2022.”

Hanging on to their #1 spot on the Top 25 List during Q1 2023 was Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil. Last quarter, Mielle took the top spot on the list as a total newcomer, having not been on the list in previous quarters, after TikTok influencer, Alix Earle, featured the brand on her list of top 2022 Amazon purchases. The brand may have also benefitted from the press around their acquisition by Proctor & Gamble in the early part of Q1. When Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil made its first appearance on the Top 25 List last quarter, it had 19k reviews on Amazon. In just three months, at the end of Q1, the product’s review count had grown an impressive 74% to over 33k, with an average rating of 4.6 out of 5.0.

Other new, prestige items that made it onto the Top 25 List in Q1 were Sol De Janeiro Body Fragrance Mist (#9) and COSRX Snail Mucin Power Essence ( #20). They joined prestige Top 25 List mainstays like Paula’s Choice 2% BHA Liquid (#6), TruSkin Vitamin C Serum (#17), and Elta MD UV Clear SPF 46 Face Sunscreen (#21). Perennial favorites like Mighty Patch Pimple Patches (#2), Essence False Lashes Mascara (#3), and Neutrogena Face Wipes (#4), rounded out Q1’s top five best sellers in the beauty category.

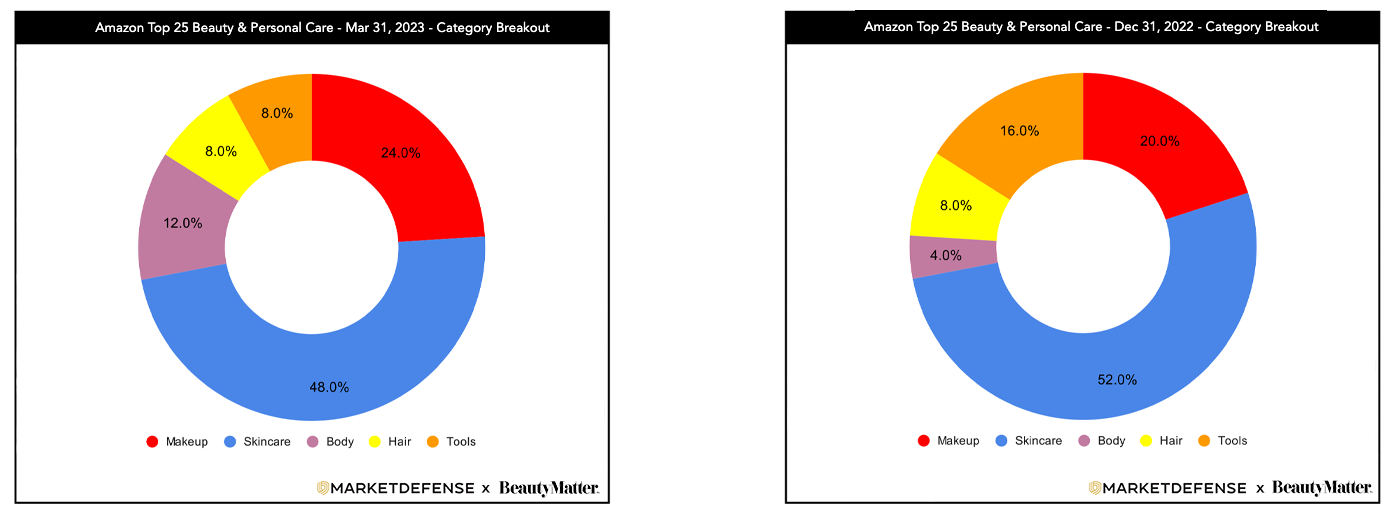

In terms of the beauty categories that comprised the Top 25 List in Q1, Amazon customers shifted some of their spending versus 2022. Skincare products represented the lion’s share of the Top 25 List, representing 48%, a four-percentage point decline from last quarter. Makeup picked up all of that volume, with a four-percentage point increase versus last quarter to 24%. Body increased eight-percentage points to 12% at the expense of tools, which declined eight-percentage points to just 8% of the Top 25 List. Hair held steady at 8%.

In a shift from previous quarters, the top 10 skincare products on Amazon during Q1 2023 began to shift away from the usual mass market brands (like CeraVe, which represented 40% of the category last quarter) in favor of more prestige brands like TruSkin, COSRX, and Elta MD, alongside Paula’s Choice, which has been on the list for the last several quarters. Top 10 staples from Neutrogena, PanOxyl, and Hero Cosmetics rounded out the skincare top 10 during Q1.

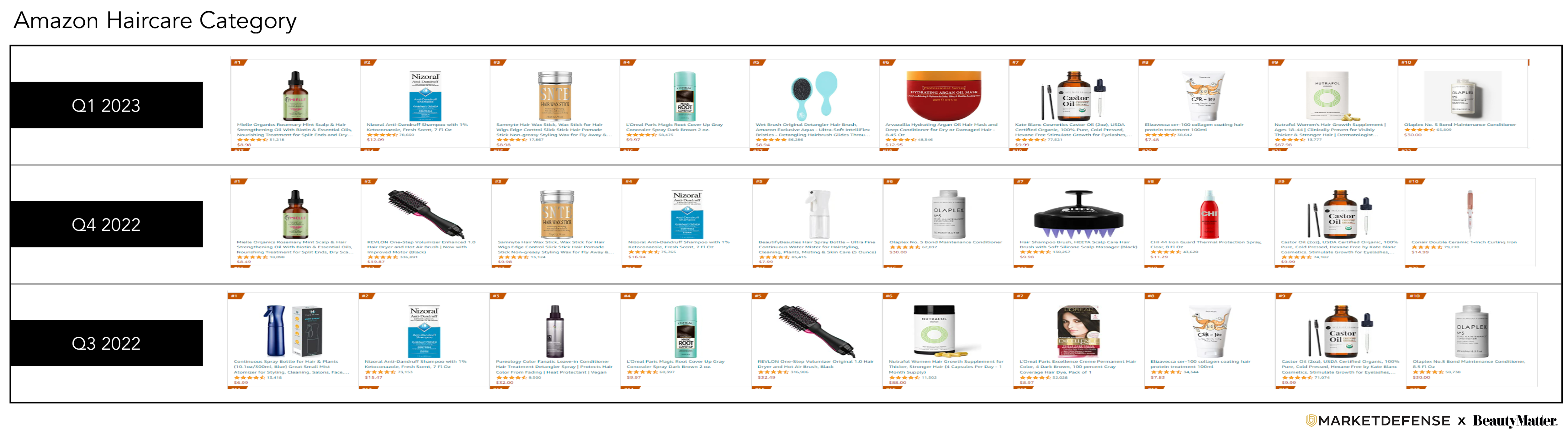

The Haircare Top 10 was led by Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil, which held onto the top spot on both the Haircare Top 10 List and the Top 25 List after making its first appearance on the list last quarter.

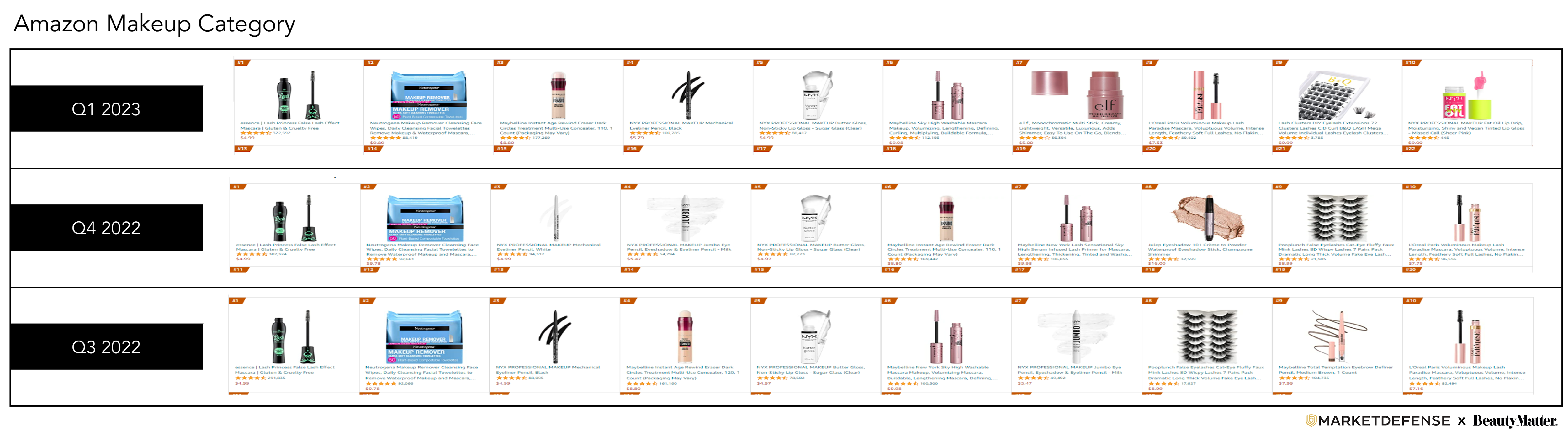

The Makeup Top 10 was consistent with previous quarters, highlighting favorites from Essence, Maybelline, NYX, Neutrogena, and L’Oréal. Once again, the average price point of the Makeup Top 10 was well below that of skincare and haircare at just $7.58, a 7% decline from last quarter and 45% below the Top 25 List average during Q1 2023 of $13.78.

Reviews remain an essential selling tool on Amazon. Mielle was able to increase the number of reviews on their Rosemary Mint Scalp & Hair Strengthening Oil by 74% as sales velocity increased. As a result of the largely positive reviews, sales momentum for the product will continue to grow, creating a circular effect. How exactly can beauty brands grow their review count on Amazon?

Here are some tips from the Market Defense Growth Management team:

Though newcomers Sol de Janeiro and COSRX may be new to the Top 25 List, they have been available on the consumer retail market for years. How likely is it that a new-to-market product could surface to the Top 25 Amazon List? If a brand can create a viral sensation for the launch of a new product, they may be able to crack the Top 10 List.

While the majority of American consumers are starting their shopping on Amazon, 43% of the Gen Z audience start on TikTok,and they are most responsible for driving the viral attention products like Mielle Rosemary Mint Scalp & Hair Strengthening Oil needed to propel them to Amazon’s #1 selling Beauty & Personal Care product. If the TikTok audience can be galvanized to support a new-to-market launch, we very well could see a viral hit on Amazon at the same time it is growing elsewhere. 2023 could be the year.

2022 Reports:

Q1 2022 Amazon Top 25 Beauty & Personal Care

Q2 2022 Amazon Top 25 Beauty & Personal Care

Q3 2022 Amazon Top 25 Beauty & Personal Care

Q4 2022 Amazon Top 25 Beauty & Personal Care